Accounts Payable Information

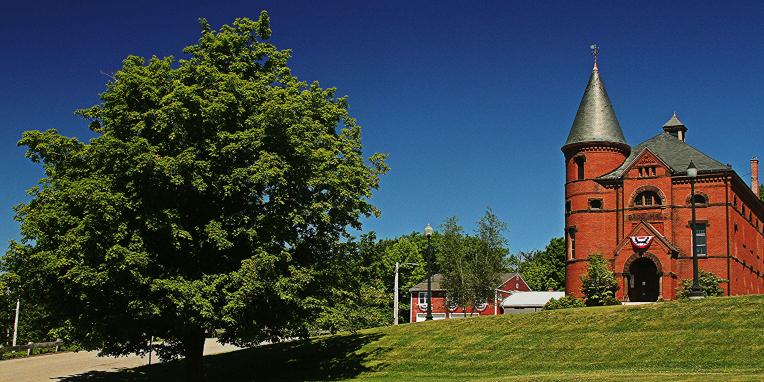

Town of Princeton

Accounts Payable: How to submit bills for payment

Submission Process

- Submit a signed schedule of bills for each account with the account number included and the invoices listed, summed and clipped to the back of the schedule. Please be sure to have the department head or authorized person sign the schedule.

- Bills submitted for approval need to be in the accountant’s box no later than the time deadline and due date of the warrant (See Warrant Schedule).

Invoice Requirements

- Payments are not made without invoices (Exceptions noted below)

- Monthly statements from vendors must be accompanied by supporting invoices. Please list the invoices separately. Do not list statement total.

- List invoices from the same vendor in succession on the bill schedule.

- Invoices must show the number of items received, cost per item, and the total amount charged, description of the supply or service provided, and mailing address. If that information is not on the invoice a written description should accompany the bill schedule.

- When paying phone bills the schedule of calls sent by the phone company should be submitted.

- If you would like to split an invoice and pay from more than one account write on the invoice the accounts and corresponding amounts to pay, and make a copy of the invoice for each of the accounts and attach a copy to the bill schedule for each account.

Invoice Exceptions

- When reimbursement is needed for a purchase or service made by someone other than the direct vendor please submit the receipt or invoice and proof that you made the purchase. Proof of purchase could be a copy of the cancelled check (front and back), credit card statement showing that the payment was made, or a signed cash receipt from the vendor.

- When partial reimbursement is needed from a register tape the amount(s) need to be circled and totaled. Also please include the name and address of the person to whom the reimbursement is payable.

Reminders

- The town is exempt from paying sales tax. Copies of the town’s exemption certificate are available and should be given to vendors when making taxable purchases.

- Goods and services are not paid for in advance. Magazine subscriptions, postage stamps, association dues, and meeting/workshop fees are exemptions.

Checks

- Checks are issued on the Wednesday after the Board of Selectmen approves the warrant.

- If you wish to have the check returned to your department rather than mailed please put a sticky note with instructions on your bill schedule when you submit for payment.