How to Pay a Bill in the Town of Princeton

Pay Bills On-Line or with a Mobile Device

We offer the convenience of making payments to Princeton from your phone.

With UniPay, you can easily pay your town bills ONLINE, using your Mobile device.

Have your checkbook or credit card in hand

UniBank, our banking partner, will charge a nominal processing fee for credit card payments. A fee schedule is located on the welcome page for your convenience. Use your checking account and there will be a nominal $.50 per cart fee.

It’s convenient, fast and secure.

Credit Card Payments

Payment by credit card may be made only through the on-line payment system, Unipay. A convenience fee will be charged by the credit card company and must be paid by the bill payer.

Bank Online Payment Systems

Some residents prefer to pay their municipal bills using online systems offered by their bank. We will accept these payments. If possible, make one payment per bill. If we cannot determine which bill you are paying, we will mail your check back and ask that you return it with the appropriate bill form.

To avoid having these types of checks returned to you, please make sure that it is clear what type of bill is being paid, and please include the bill number and year.

By Mail to our Secure Lock Box Service

Tax bills may be mailed to:

Please include the remittance copy located at the top of your bill to ensure that your payment is properly credited.

By Mail

Tax bills may also be mailed to the office at:

Please include the remittance copy located at the top of your bill to ensure that your payment is properly credited.

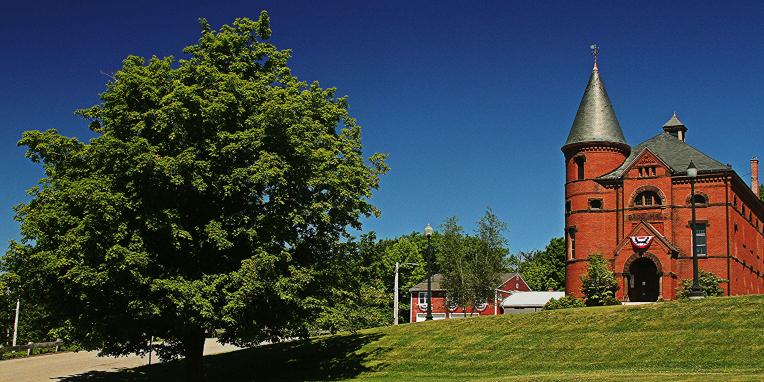

Mail slot in Town Hall door

There is a locked box located in the front door of Bagg Hall. Payments that are left in the box after tax due date cut-off time will be credited to your account as of the next business day. Please be aware of the due date of your bill and the time of day in order to ensure that your payment is credited to avoid late charges.

In Person

To pay your bill in person, you must visit the Collector’s Office in the Bagg Hall, 6 Town Hall Drive, Princeton, MA 01541-1137. If you want a receipt for your payment, bring the entire bill to the office.

Cash Payments

Please do not send cash by mail. Please do not leave cash in the mail slot. If you wish to pay in cash, the safest way to do so is to pay at the office during normal business hours.

Checks

The Town of Princeton accepts only checks that are made payable to “Princeton”. We do not accept checks made payable to a third party, even with an endorsement. This is simply good business practice. Most of the time, we can accept personal checks in payment of your bills. The following occasions are exceptions. In these cases, delinquents would have received letters advising them as to the acceptable methods of payment.

Late Motor Vehicle Excise Tax

If you have been marked at the Registry of Motor Vehicles and cannot renew either your license or automobile registration because of an outstanding Motor Vehicle Excise bill, we cannot accept payment for a tax bill that has already been turned over to the Deputy Tax Collector. You will need to contact call Jeffery and Jeffery, Deputy Tax Collector, at (413) 967-9941 www.jefferyandjeffery.com

The Registry of Motor Vehicles will notify you if you have a marked bill.

Check Dates

When you make a payment with any type of check, the check must be dated no later than the date on which you are tendering payment. We cannot accept checks which are post-dated, that is, are dated in the future. Please remember this when you make out your check. If you send us a post-dated check, it will be returned to you, and we will ask you to change the date and to initial your change.

Insufficient Funds Checks

Any check which is returned to this office and, for whatever reason, is not honored by the payer’s bank, will be subject to the statutory penalty as outlined in Massachusetts General Laws, Chapter 60, Section 57A. The penalty is 1% of the face value of the check with a minimum charge of $25.

If your check is returned to us, we will not redeposit it until we have collected the $25 penalty charge. If the penalty is not paid, we will charge back the payment to the appropriate account.

If the insufficient funds check was in payment of a tax bill, and if the payment due date has passed, interest and all other applicable fees will be charged to the account.

Timely Payments

Payments must be received in the Collector’s Office by the due date in order to be considered “on time.” Postmarks are never accepted. This policy is in accord with the ruling of the Massachusetts Department of Revenue on what constitutes “timely payments.”