Letter from Selectboard re: Town Revenue Sources

The following is a message from the Princeton Selectboard. Attached is a copy of the same information, in a formal letter format.

October 25, 2018

Letter from the Selectboard regarding Town Revenue Sources

Dear Princeton Residents,

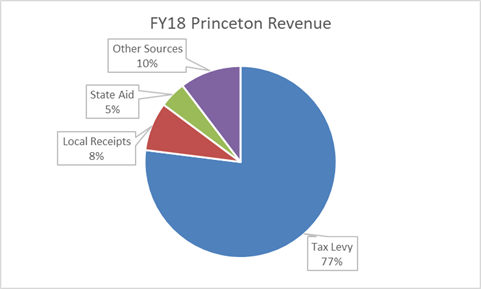

In this letter, we would like to address the receipts (revenues) side of our budget. Our ability to spend is tied to our sources of revenue. Please note that the dollar figures and percentages below are approximates. Exact numbers and more detail can be found in the budget spreadsheets you can request from the Town Administrator.

Revenue Summary

Approximately 90% of Princeton’s revenue comes from town residents and taxpayers in one form or another. There are four categories of revenue for the town (data from the Division of Local Services):

FY18 Tax Levy ($8,490,000)

Property taxes are levied primarily on real property (land & buildings). In accordance with State law, the Town’s Board of Assessors determines the fair market value of all property every five years. This will be done in FY19. Interim adjustments are performed each year when a full revaluation is not required.

FY18 Other Sources ($1,140,000)

The State’s Division of Local Services (DLS) defines Other Sources to be money from stabilization funds (funds designed to accumulate amounts for capital and other future spending purposes) and certified free cash (money, previously raised through taxation but unspent, surplus revenues, prior year’s free cash, or outstanding property taxes).

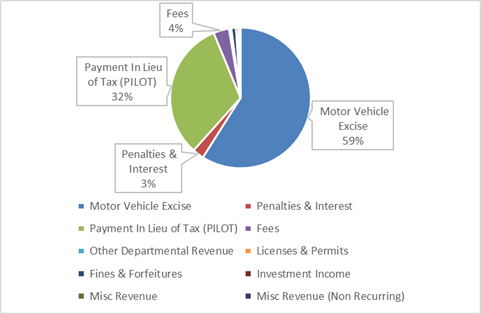

FY18 Local Receipts ($905,000)

Local receipts are locally generated revenues, other than real and personal property taxes. In Princeton, the two largest categories are Motor Vehicle Excise (59%) and Payment in Lieu of Tax (PILOT, 32%). PILOT and a few of the other categories are explained below.

Payment in Lieu of Tax (PILOT) comprises money from four different sources (actual $ from FY18):

Commonwealth of MA ($256,767)

Per Massachusetts state law, the State compensates 29 towns and cities that contain state-owned land purchased to protect the water supply. It does not include all state-owned land in town. The number increases a little each year and attempts to equal the amount which the town would receive in taxes upon the fair cash valuation of the land. Note that there is a “hold harmless” clause that ensures that this value will not decrease. Per the MA Department of Revenue, the State owns 126 lots, comprising 4063 acres of watershed land, with total valuation of $18,454,600 in 2017.

Worcester ($33,375)

Worcester owns 7 parcels in town. These were purchased to help protect their water supply.

City of Fitchburg ($9,822)

Fitchburg owns 6 parcels in town. These were purchased to help protect their water supply.

Maclean Hospital ($14,758)

Maclean Hospital entered into a voluntary agreement with Princeton to make a series of payments in lieu of taxes when they purchased the Fernside property on Mountain Road.

Note that there have been multiple bills introduced by State legislators that attempt to allow towns to collect taxes on land owned by non-profits (such as land trusts) up to 25% of what would be paid if the property weren’t non-profit. The most recent two bills did not make it to the floor for a vote.

Penalties & Interest is interest on property taxes, excise taxes, and tax liens.

Fees contains many items, the largest of which are School Land Maintenance (payments by Wachusett Regional School District for maintenance of Thomas Prince athletic fields and parking lots), Tax Collector fees (include flagging fees to mark people at the registry who have not paid their excise taxes, so they can't renew their license, demand fees for property taxes, and municipal lien certificates), Dog Licenses, and Off-Duty Admin fees (we charge vendors for the processing cost of police special duty). Note that some fees, such as building permit fees, offset expenses in the budget and don’t appear here.

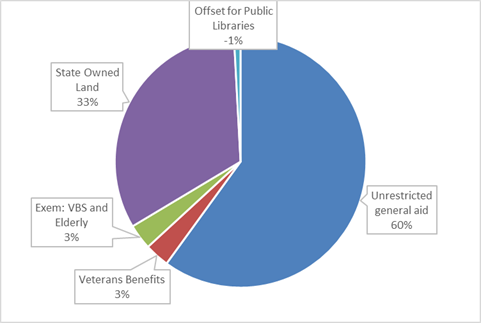

FY18 State Aid to Princeton ($493,000)

This is sometimes referred to as the Cherry Sheet because of the color paper on which it used to be printed.

- Note that no school funding appears on Princeton’s Cherry Sheet because it goes directly to the Wachusett Regional School District.

- Unrestricted general aid is a distribution of the State’s lottery proceeds and is based on a town or city’s population and prorated by a relative wealth factor. Towns with higher property values get proportionately less general aid.

- Offset for Public Libraries is money from the State that must be used for the library and is based on the town’s population per square mile.

- Veterans Benefits: The program reimburses 75 percent of a municipality's costs for veterans' and their dependents' benefits

- Exem: VBS and Elderly: The program partially reimburses municipalities for property tax exemptions granted to qualifying veterans, blind persons, surviving spouses and elderly persons. The level of reimbursement varies by class of exemption but is based on actual town expenses.

How is the Tax Rate Set?

In the fall, working with the budget and other warrant articles that voters approved at the Annual Town Meeting and the expected other sources of revenue, the Board of Assessors sets the property tax rate ($/$1000 of assessed value) and the Selectboard approves it.

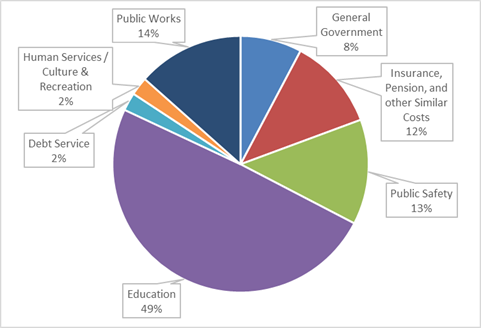

How do we Spend this Money?

This data is for FY16 and is from the Division of Local Services.

Sincerely,

The Princeton Selectboard

Richard Bisk, Chair

Karen Cruise

Edith Morgan